Customer acquisition cost or CAC is a crucial business metric for determining the resources needed to attract new customers, and how that impacts the profitability of your business. You need to understand how to calculate CAC in order to grow your customer base while continuing to make a profit.

In this ultimate guide to CAC for B2B businesses by OneIMS, you’ll discover how to calculate CAC, the significance of CAC, and how you can reduce your CAC to increase your profitability.

What is CAC?

CAC is the amount you spend on marketing and sales for acquiring new customers. It includes every little cost, from salaries and bonuses of your marketing and sales teams to the larger amounts that you spend on advertisements and marketing.

The formula for calculating CAC is:

For example, if you spend $50,000 on acquiring 50 customers, your CAC is $1000.

How Do You Determine Your Profit Against CAC?

In order to determine your profitability against CAC, you must measure a customer’s lifetime value or LTV. LTV will determine the revenue a customer will generate your business the entire time they have a relationship with you.

In order to calculate LTV, you must consider the following:

APV (average purchase value) – You can get this amount by dividing the total revenue your business has earned over a certain period of time by the number of purchases made within that same period of time.

APF (average purchase frequency) – To calculate this, you must divide the number of purchases made by the number of unique customers.

Once you have the values for APV and APF, your next step would be to calculate customer value, or CV. The formula for calculating CV is CV = APV x APF.

Before you can calculate your LTV, you must determine the ACL or average customer lifespan for your business. This is the average of how long a customer keeps purchase from your business.

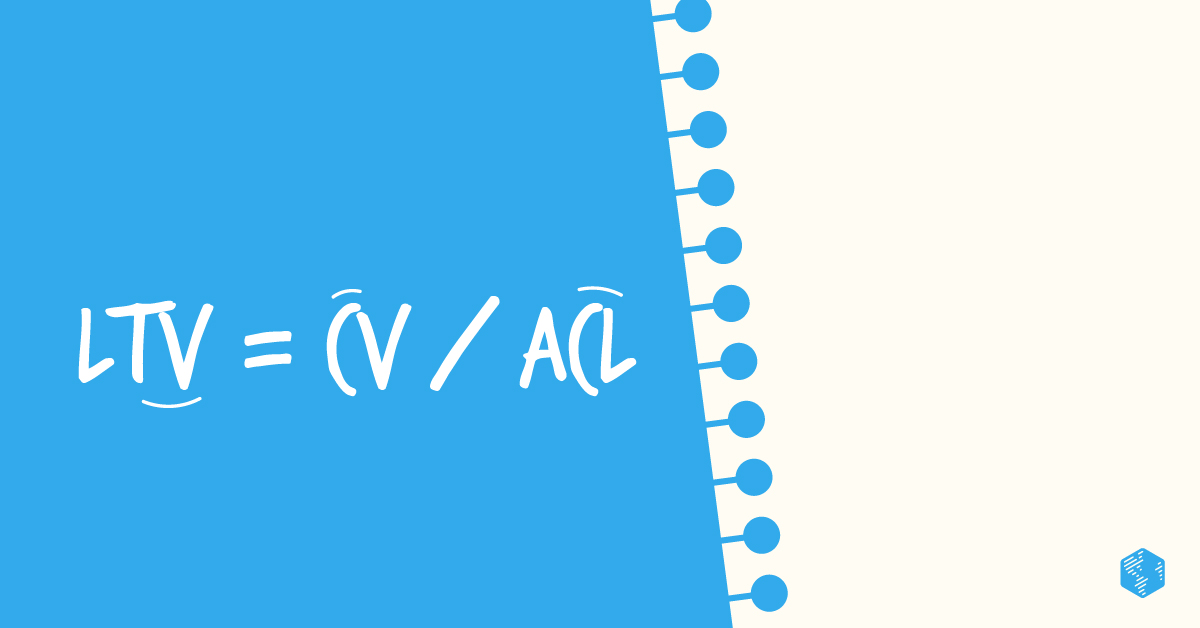

When you have determined both the CV and ACL, you can then calculate the LTV of your customers. The formula is:

LTV = CV/ ACL i.e., the customer value divided by the average lifespan of a customer.

The value you get is the estimate of the amount of revenue a customer generates on average, over their lifetime of relationship with your business.

The ratio of LTV to CAC would give you an estimate of your profitability against your CAC. In simple terms, the ratio would help you to understand how much you earn from the customers against how much you spend on acquiring them. Understanding this ratio is crucial because it can help you determine if you are spending too much on CAC or too little. You can then utilize this information to adjust your budget accordingly.

The Ideal LTV and CAC Ratio

Firstly, it is important that your CAC remains lower than the value of your customers’ LTV, because only then can you ensure profitability for your business.

The ideal LTV: CAC ratio is 3:1, meaning, the value you get from your customers should be three times the cost of acquiring them. If the ratio becomes 1:1, it is an indicator that you are spending more on your marketing and sales effort than you should. Instead, you should focus more on retaining your customers to increase your LTV. On the other hand, if the ratio becomes 4:1 it shows that you are not spending enough on customer acquisition and might be losing out on generating more valuable leads for your business.

The ideal LTV: CAC ratio is 3:1, meaning, the value you get from your customers should be three times the cost of acquiring them. Click To TweetHow Do You Reduce Your CAC?

There are ways to minimize your CAC. Here are three strategies:

Inbound Marketing

Concentrate your marketing efforts on bringing in customers through inbound marketing. Techniques such as email marketing, social media marketing, and content marketing can prove to be useful in minimizing your CAC.

Marketing Automation

A large amount of customer acquisition investment goes into the salaries, bonuses and commissions of the marketing and sales team. By automating certain marketing efforts such as email, chatbots for replying to general inquiries, you can lower your CAC.

In fact, marketing automation software can handle much more than that. It will not only reduce human intervention significantly, but can also provide accurate analytics of your marketing efforts, create reports, assist in email targeting, and increase lead generation as well.

Customer Retention

According to Harvard Business Review, it is five to 25 times more expensive to acquire new customers than retaining existing ones. It makes sense, right? Instead of spending a large amount on acquiring new customers, you can continue to nurture existing ones with exceptional customer service. Customer retention strategies work in two ways to reduce your CAC. For one, existing customers will continue to contribute revenue to your business, therefore raising their LTV. Secondly, if your customer service team can maintain good customer relationships and retain customers, they can help you to receive more customers through reviews, word-of-mouth marketing, and referrals as well.

Final Thoughts

For more information on figuring out your CAC, contact us at OneIMS. Our marketing experts would be happy to work with you and answer any questions you may have!